On a consolidated basis Q-o-Q basis: RIL clocked a revenue growth of +12.2%/of Rs. 172,956 crore , led by growth in revenue of:

- +15.8% from the refining business : Higher volumes despite lower Gross Refinery margins (GRM’s) of $8.1/barell; which is lowest in 18 quarters vs. $8.2/barell in 4QFY19 (GRMS;’s stood at $10/barell in 1Q FY19) contributed to the growth in the overall revenue. The street was disappointed as the street expected $8.5/barell.

- +9.6% from the Digital Services: Subscriber base as on 30th June-19 of 331.3 million with net addition of 24.5mn during the quarter. Jio now enjoys a lowest churn in the industry at 0.97% per month. APRU fell for the sixth straight quarter to Rs. 122 /subscriber per month vs. Rs. 126.2/subscriber per month in 4Q FY19 as the company added mostly lower revenue generating subscribers, and this remains a cause of concern.

- +4.2% in the Retail business: Reliance Retail operated 10,644 stores across 6,700 plus towns and cities, with an area of 23 mn. sq.ft. Rapid store expansion particularly in Tier 3/ Tier 4 markets have been key drivers for robust growth in retail business.

The growth in these three segments was partly offset by de-growth in the revenue by -11.3% in Petrochem Business due to decrease in volumes and price realizations & by de-growth in the revenue by -13.7% in Oil & Gas business due to decline in volumes.

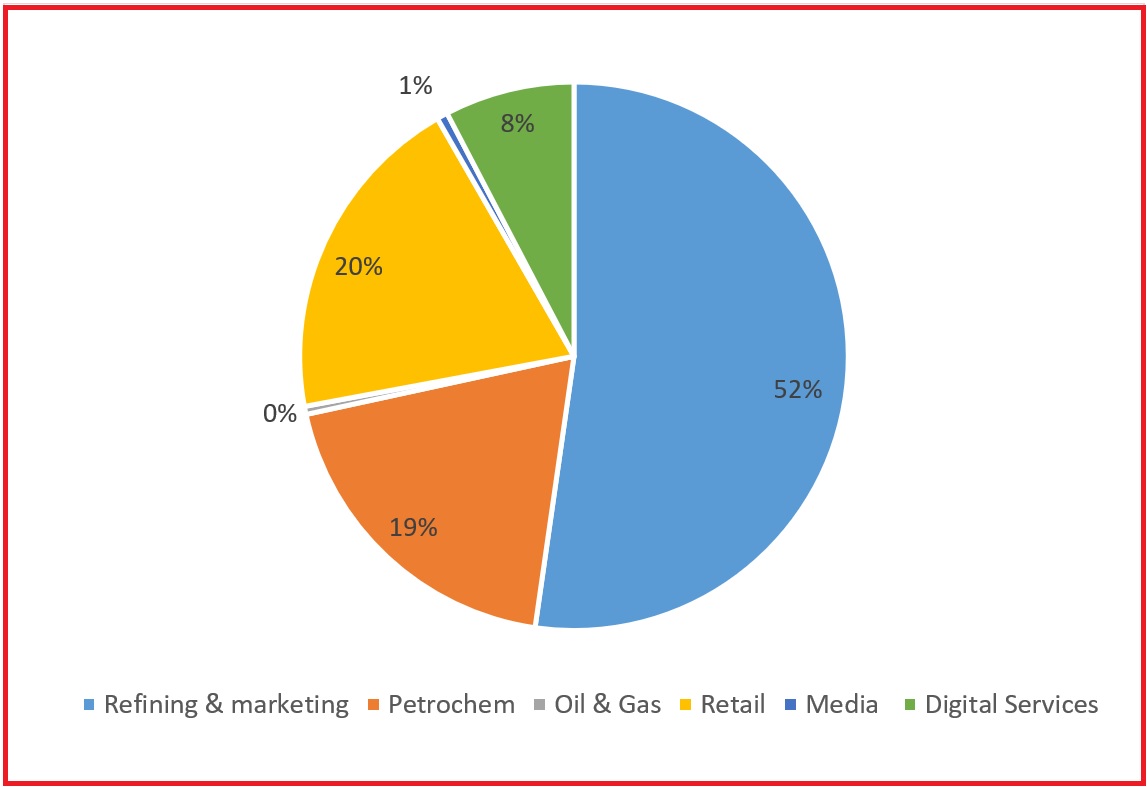

Overall the revenue contribution from each segment for 1Q FY2020 is as under:

| Consolidated results Rs. In crs. | ||||||

| Segment Revenue | 1Q FY20 | 4Q FY 19 | 1Q FY19 | % Change Q-o-Q | % Change Y-o-Y | |

| Refining & marketing | 101,721 | 87,844 | 95,646 | 15.8% | 6.4% | |

| Petrochem | 37,611 | 42,414 | 40,287 | -11.3% | -6.6% | |

| Oil & Gas | 923 | 1,069 | 1,432 | -13.7% | -35.5% | |

| Retail | 38,196 | 36,663 | 25,890 | 4.2% | 47.5% | |

| Media | 1,245 | 1,231 | 1,124 | 1.1% | 10.8% | |

| Digital Services | 14,910 | 13,609 | 9,653 | 9.6% | 54.5% | |

| Consolidated Revenue excluding inter-segment | 172,956 | 154,110 | 141,699 | 12.2% | 22.1% | |

| EBIT Margins & EBIT segment wise | ||||||

| Refining & marketing (4.4%) | 4,508 | 4,176 | 5,315 | 8.0% | -15.2% | |

| Petrochem (20%) | 7,508 | 7,975 | 7,857 | -5.9% | -4.4% | |

| Oil & Gas | (249) | (267) | (447) | -6.7% | -44.3% | |

| Retail (4.7%) | 1,777 | 1,721 | 1,069 | 3.3% | 66.2% | |

| Media | (82) | (40) | (70) | 105.0% | 17.1% | |

| Digital Services (20.7%) | 3,080 | 2,665 | 1,715 | 15.6% | 79.6% | |

| Consolidated | ||||||

| PBDIT | 24,486 | 24,047 | 22,449 | 1.8% | 9.1% | |

| Net profit | 10,104 | 10,362 | 9,459 | -2.5% | 6.8% | |

| EPS | 17 | 18 | 16 | -2.3% | 6.9% | |

| PBDIT margin | 14.2% | 15.6% | 15.8% | |||

| Net profit margin | 5.8% | 6.7% | 6.7% | |||

On an absolute basis, overall PBDIT witnessed a growth of +1.8%/Rs. 24,486 crs. Mainly due to:

- Higher contribution from digital services by +15.6%/Rs. 3080 crs. & EBIT margin increased to 20.7% vs. 19.6%.

- +8%/4508 crs. Growth in refining business however EBIT margin shrunk to 4.4% vs. 4.8%.

- 3.3%/Rs. 1771 crs. From the retail business with EBIT margin remaining constant at 4.7%.

The above two segment growth in PBDIT, more than offset the weakness in petrochemical (due to lower volumes, however EBIT margin improved to 20%), thereby leading to a PBDIT growth of +1.8%/Rs. 24,486 crs.

Finance costs increased by +4.4% /Rs. 5,109 crore due to higher debt. Outstanding debt as on 30th June, 2019 increased to Rs. 288,243 crore vis-à-vis Rs. 287,505 crore as on 31st March, 2019. Resultant a decline in PAT by -2.5%/Rs. 10104 crs on a Q-o-Q basis.

Final takeaway:

Overall it is a mixed bag; on the revenue front a robust continued growth in retail and digital services is witnessed due to addition in stores and subscribers respectively. However the margins have shrunk due to contraction in GRM’s in the refinery business and continuing decline in ARPU’s in the digital business remains a cause of concern.

The street had already baked in the pressurized margins, as the stock closed at Rs. 1253 ahead of the results.

Technical Wise

As per the charts Reliance Friday closed was at exact Do or Die Position. A close below 1245 with Heavy Volume that means Breakdown starts for Target of 1225-1200 & If if bounce from 1245 then Resistance of 1300 will act as selling pressure. Even If you check 2 Hour chart, there you will get Proper formation of Rectangle, If it closes below 1245 then Target 1190, If closes above 1300 then target 1360, Here Breakout and Breakdown only confirms when it matches all confirmations.

Even If you check 2 Hour chart, there you will get Proper formation of Rectangle, If it closes below 1245 then Target 1190, If closes above 1300 then target 1360, Here Breakout and Breakdown only confirms when it matches all confirmations. This is simple Technical things, everything is clear from this, 1245 is do or die mark, and if I check my additional system then Volatility is very lowest in last 4 months, This volatility is different as this is modified by me & which side it will rally or fall it depends on the How it moves and closes on Monday, Expecting minimum 6-8% either side move in next 3-5 weeks in Reliance.

This is simple Technical things, everything is clear from this, 1245 is do or die mark, and if I check my additional system then Volatility is very lowest in last 4 months, This volatility is different as this is modified by me & which side it will rally or fall it depends on the How it moves and closes on Monday, Expecting minimum 6-8% either side move in next 3-5 weeks in Reliance.

Other ways to connect with us.

Website : www.cityinvestwisely.com

Facebook Page : https://www.facebook.com/cityinvestmentservices

Telegram Equity Channel : https://t.me/cityinvest

Telegram FNO Channel : https://t.me/cityfno

Telegram Equity Group for Discussion : https://t.me/Stocktalkdiv

Telegram FNO Group for Discussion : https://t.me/Fnotalkdiv

Telegram All world Assets Information : https://t.me/allworldassets

Quora : https://www.quora.com/profile/Divish-Saini-2

Twitter : https://twitter.com/gameoftrend