After Waiting for 5 weeks Nifty still not able to cross 10985 Resistance, Now it’s really hard to cross that mark again. Last 5 weeks, everyone was waiting for the Budget, and on Budget day it made a Bearish Sign.

So Better to Hold cash for the last Panic in the market. Many Good shares going towards their long term support, Earlier they broked Short term and Medium term support, So now in the next Four months Starting from 4th Feb till 4th June Du to the election there will be a lot of fluctuations in Market.

I hope you all know about the three legs of selling in the market, which I described in My 17th Dec 2018 article ” Market conditions: When to buy shares?”

Small caps are now under last panic attack.

Midcaps stocks like Eicher motors, HDFC Life, Deepak Nitrate, are going to touch last long term support of 16500, 315, 180 respectively.

Large caps stocks showing sign of topping out like Hind Unilever, HDFC Bank, HDFC, LT they will go to their medium-term support.

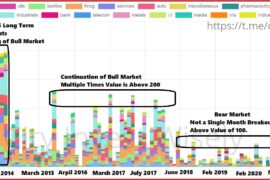

From these all things, we will get the idea that the market can take a dip in the next 4 months and we will get a good opportunity for buying.

For Nifty to rally it has to close above 11k mark ( Spot Levels). A closing above 11k is must for a further rally in the market.  Many times is touched 980’s levels but four times it reversed back from that levels, Earlier I was waiting for Budget to get some clarity about Nifty Movement but I am getting a sign of Bearishness in the market.

Many times is touched 980’s levels but four times it reversed back from that levels, Earlier I was waiting for Budget to get some clarity about Nifty Movement but I am getting a sign of Bearishness in the market.

The Budget, we can say a big trigger for the market trend for the next 2-4 months and on Budget day we got a shooting star. Many people will get trap by reading Moneycontrol article in which they marked shooting star as reversal signal, But it can be a trap, we have to wait for confirmation of shooting star, before that we can’t make any trade it can be a trap, Because as per bookish language many people will try to short Nifty, But for me, there is no trade.

And by looking into the Nifty chart, it looks like a trap rally can be there, from past 5 weeks it’s into a range of 10580-10980, many times it gave fake Breakdown and Fake Breakout, now we can’t trust Nifty Index Chart.

Short term range of Nifty not able to give us some indication of Rally or fall, so we have to move to Medium Term Range, on that basis we can say 11210 on the upper side and 10550 on the lower side.

Still, by looking into the chart I am not fully confident that market can go beyond 11200, At 11200 it will try to attract many retail Investor in the market and then it will come down to a range of 10600-10900. Till Election (April- May) Accumulate cash so that you can buy good companies at lower rates.

Trap Trap Trap, everywhere trapping going on, Better to Keep distance from market, for next 3-4 months, If you are new in the market then just track the market, If you are 1-year-old in the market then keep track on some individual stocks which have some good trend. If you are 2-4 years old in the market then focus on your portfolio, try to add/average your best stocks in the next 2-4 months.

When there is no trend in the market then focus on learning and be ready for the next trend.

2 Comments

Very good surprisingly of the stockmarket

Thanks 🙂